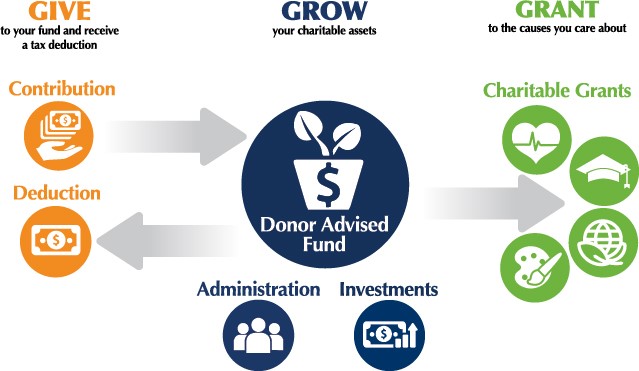

A donor advised fund is an ideal tool to consider if you have an increase in income due to a bonus or equity transaction and are looking for a way to minimize the tax burden and satisfy some philanthropic giving. The donor advised fund is an account structure offered by many large investment firms for charitable giving. You can fund the donor advised fund with low cost securities or cash, and qualify for a charitable deduction. The same phase at rule applies, so you should check with your advisors to determine appropriate amounts. The main benefit of the donor advised fund is the ability to fund a charitable entity without having to name or give funds to a specific charity that year. The donor advised fund allows you to capture the tax deduction, but distribute the fund proceeds to charities, like SOAR, for several years to follow.

DONOR ADVISED FUNDS